nc sales tax on non food items

Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Lease or Rental of Tangible Personal Property.

. Click here for extremely detailed guidance on what grocery items are and are not tax exempt in New York. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged on qualifying food which includes groceries and bakery items sold without eating utensils.

Select the North Carolina city from the list. Nc sales tax on non food items. Is Food Taxable In North Carolina Taxjar Sales Tax On Grocery Items Taxjar Sales Tax On Grocery Items Taxjar.

21 rows While the North Carolina sales tax of 475 applies to most transactions there are certain. You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin. The information included on this website is to be used only as a guide.

North Carolina Sales Tax Small Business Guide Truic Sales And Use Tax Sales Tax Information Tax Notes. Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale. North Dakota grocery items are tax exempt.

With local taxes the total sales tax rate is between 6750 and 7500. North Carolina has recent rate changes Fri Jan 01 2021. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

Nc sales tax on non food items Monday March 14 2022 Edit. Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical. Food Non-Qualifying Food and Prepaid Meal Plans.

Sales and Use Tax Sales and Use Tax. Twenty-three states and DC. It is not intended to cover all provisions of the law or every taxpayers specific circumstances.

Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming. Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent.

What transactions are generally subject to sales tax in North Carolina. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2. The state sales tax rate in North Carolina is 4750.

Treat either candy or soda differently than groceries.

North Carolina Nc Car Sales Tax Everything You Need To Know

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

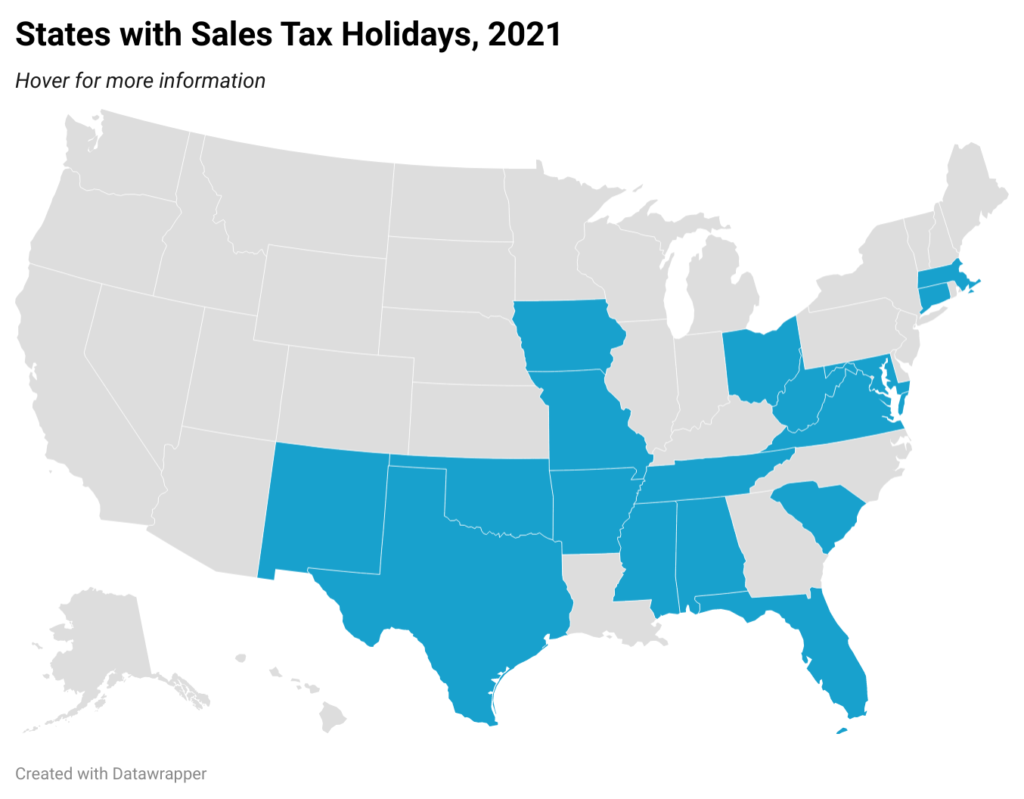

Sales Tax Holidays Politically Expedient But Poor Tax Policy

North Carolina Sales Tax Rates By City County 2022

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

64 Dollar Grocery Budget Harris Teeter

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Is Food Taxable In North Carolina Taxjar

Sales Tax On Grocery Items Taxjar

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

2020 Sales Tax Holiday Plastic Drop Cloth Hurricane Supplies Disaster Prep

Is Food Taxable In North Carolina Taxjar

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep