how to lower property taxes in california

Do-it-yourself property valuation that reduces a. DoNotPay Can Help Reduce Your Property Tax in California.

Orange County Ca Property Tax Calculator Smartasset

California has 58 counties and some variation in policies and procedures for calculating and assessing property taxes.

. Failure To File Appeal Of Supplemental Or Escape Assessment Within 60 Days Of Mailing. File for a Homestead Exemption or Credit. Number of Inherited Properties Likely to Grow.

Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year. These residents qualify for a reduced assessment while the property in question is being repaired. Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values.

The appeal process is complicated. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it. How Do I Reduce My Property Taxes.

Now that you know what its like inside the assessors office here is how to lower your property tax bill. There are however a few ways homeowners can reduce their California property taxes. Although each county has its own method property taxes are generally.

There are however a few ways homeowners can reduce their California property taxes. Option 1 Appeal The Taxable Value. ASSESSMENT INFORMATION Christina Wynn Assessor 3636 AMERICAN RIVER DRIVE SUITE 200 SACRAMENTO CA 95864-5952 Office Hours 8 am.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. 10 Commonly Overlooked Ways To Reduce California Real Property Taxes. Simple Steps To Lower Your Property Taxes.

County authorities known as assessors compute a homeowners property tax by multiplying the homes taxable value by the applicable tax rate. Contact the California Franchise Tax Board at 1-800-868-4171 if youre interested in finding out more about helping homeowners pay their property taxes. Mint Images - Bill MilesGetty Images.

Appeal the Taxable Value of Your Home. There are however a few ways homeowners can reduce their California property taxes. 1 Google assessors office.

Take these specific steps. Up to 25 cash back Method 1. Option 1 Appeal The Taxable Value.

Option 1 Appeal The Taxable Value. Disaster relief Some California counties grant property tax exemptions to individuals whose homes were seriously damaged in a disaster. You may want assistance.

Property value declining is the number one reason that California property tax appeals are filed each and every year. Monday to Friday Excluding Holidays Telephone 916 875-0700 8 am. Failure To File Appeal Of Supplemental Or Escape Assessment Within 60 Days Of Mailing.

Failure To Seek Correction of Erroneous Change of Ownership. Since property taxes are calculated from the overall property value you should always try to have your property taxes lowered if the value of your property has declined. For a home owned this long the inheritance exclusion.

Appealing your assessed value is a time-consuming process but if you are successful you can significantly reduce your property tax burden and set a precedent for years to come. The maximum income limitation for getting property tax assistance is 200000 per household if you are 62 blind disabled own and live in the home and qualify. In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area.

Assistance for the hearing impaired is available by calling 711 for California Relay Service. So if your property is assessed at 300000 and. In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area.

Since property taxes are calculated from the overall property value you should always try to have your property taxes lowered if the value of your property has declined. Try lowering your California property taxes by filing an appeal with your countys tax assessor. All but a handful of states allow you to claim your primary residence as a homestead which offers you protection from creditors and exempts you from paying a portion of your property tax bill say the first 50000 of its assessed value.

Whichever route you choose DoNotPay is your go-to resource for property tax reductions in California. Now that you know what its like inside the assessors office here is how to lower your property tax bill. DoNotPay Can Help Your Lower Your California Property Taxes in a Snap.

Property Taxes By State Embrace Higher Property Taxes

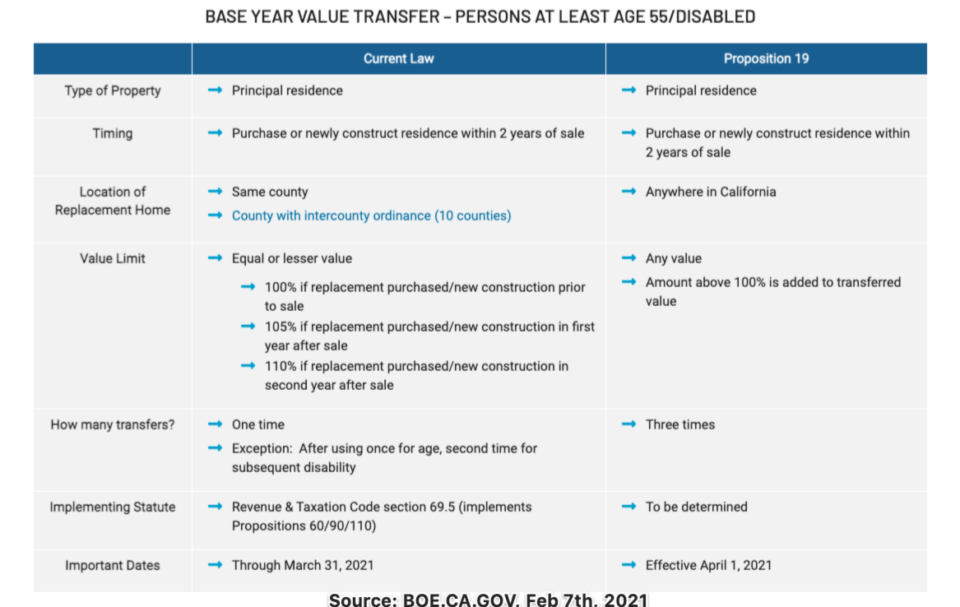

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

Payment Activity Notice Los Angeles County Property Tax Portal

The Property Tax Inheritance Exclusion

Deducting Property Taxes H R Block

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Property Tax Process Mendocino County Ca

Prop 19 And Property Taxes In California Marc Lyman

Property Tax Appeals When How Why To Submit Plus A Sample Letter

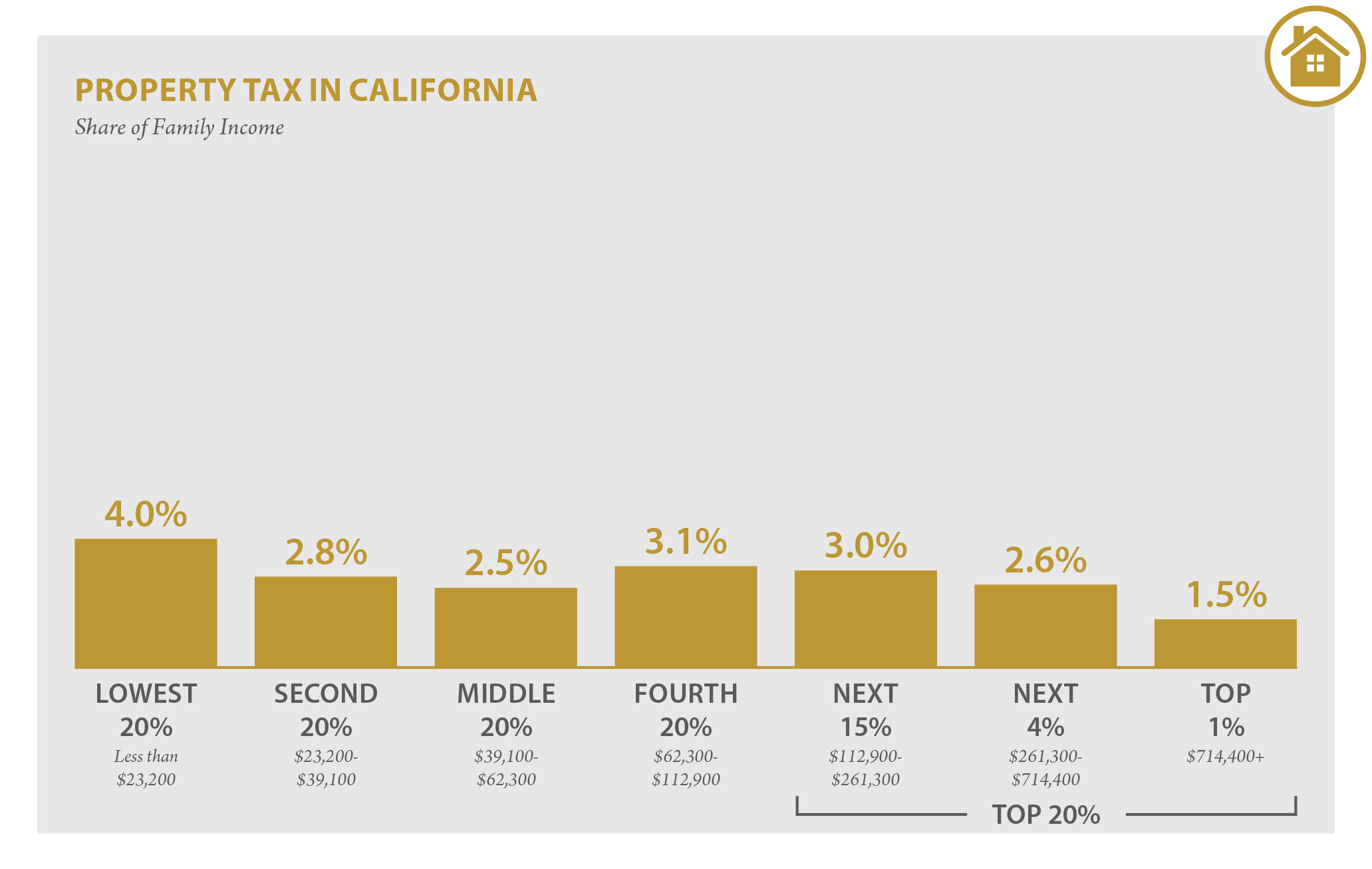

California Who Pays 6th Edition Itep

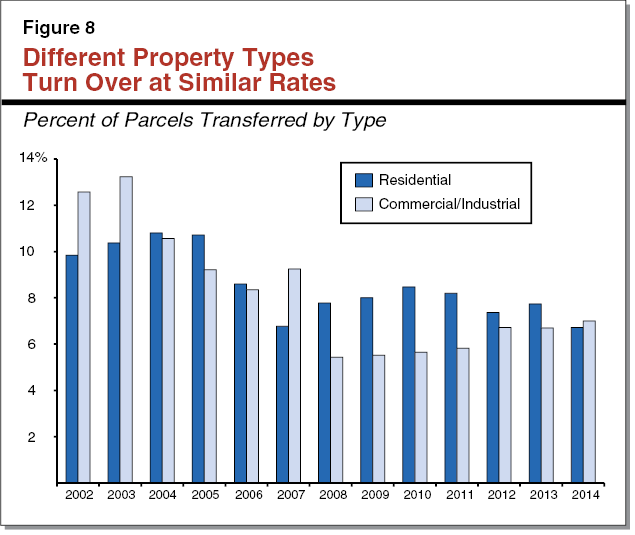

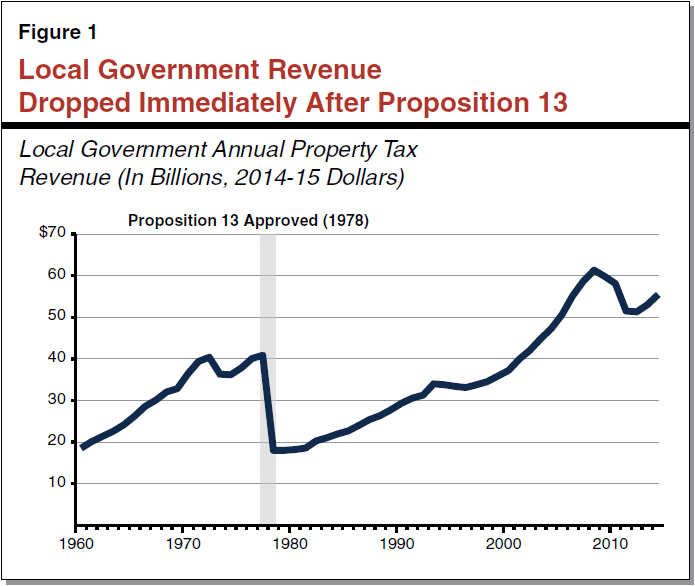

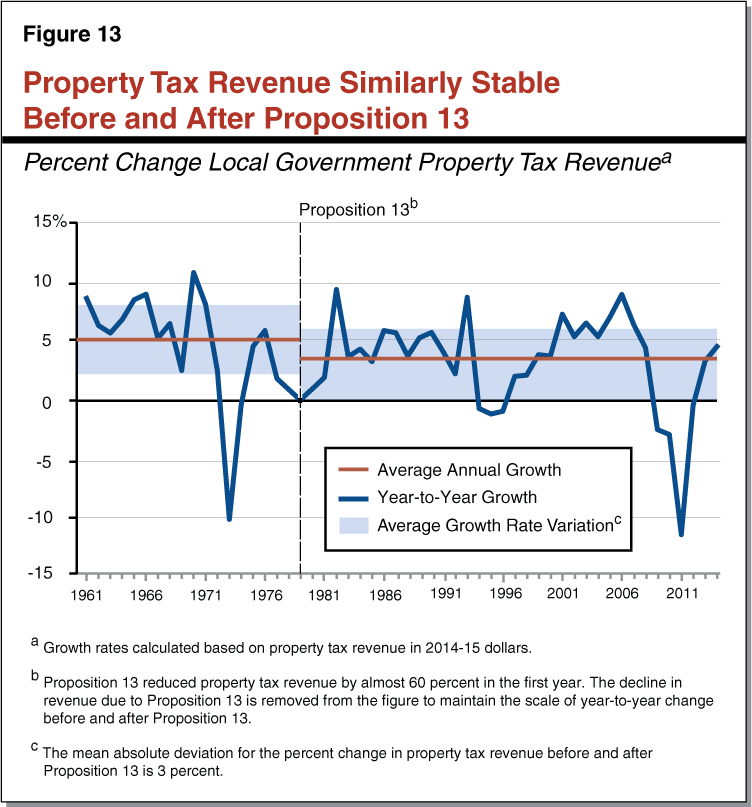

Common Claims About Proposition 13

Common Claims About Proposition 13

Common Claims About Proposition 13

What Is A Homestead Exemption And How Does It Work Lendingtree

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

Prop 19 And Property Taxes In California Marc Lyman

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center